ESG playing bigger role in rating debt issuers in emerging markets: Moody’s

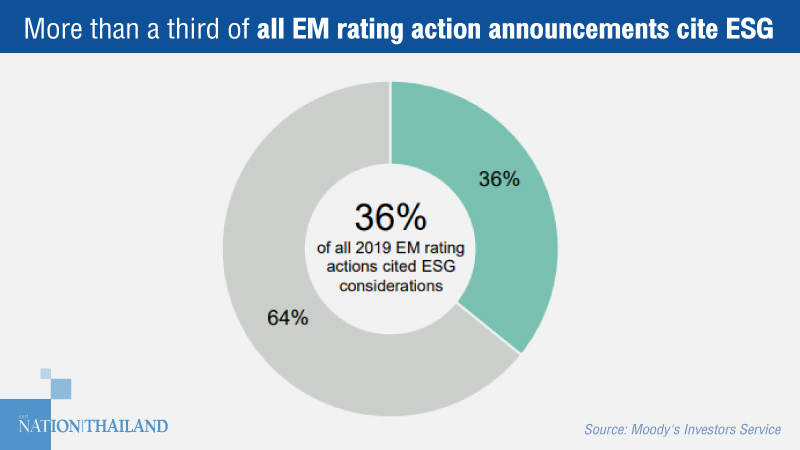

Moody's Investors Service reports that 36 per cent of its nearly 1,800 ratings of debt issuers in emerging markets in 2019 involved material environmental, social and governance (ESG) considerations, dominated by governance considerations. "

ESG risks are often higher in emerging markets [EMs] than they are in developed markets, while issuers' capacity to respond to these risks is often also weaker," said Nishad Majmudar, a Moody's analyst.

"We expect ESG considerations to become even more material to debt issuers' credit quality globally – and particular in EMs – given the range and rise of ESG risks such as climate change and public health," added Majmudar.

Of the nearly 1,800 rating action announcements Moody’s published in 2019 for both private- and public-sector debt issuers in emerging markets (EMs), 36 per cent contained references to material ESG considerations, with many containing multiple references. Cited most often by far was governance, followed by social and then environmental considerations. For public-sector rating actions, environmental and social considerations became more prevalent in 2020 and will continue to rise, said Moody’s.

It added that ESG is more often cited in emerging market public-sector rating actions (65 per cent). This reflected generally weaker institutions and thinner buffers against environmental and social risks in EMs than in developed markets, said the ratings agency. Meanwhile about one-third of private-sector EM announcements cited ESG considerations. Moody’s cited governance four times as often as environmental considerations and nearly six times as often as social considerations. The ESG citations spanned a range of sectors, indicating ESG's importance and pervasiveness as a credit consideration. Asia-Pacific, and specifically China, account for most citations.

The company said most rating actions citing ESG are directionally neutral. About 65 per cent were affirmations of an existing rating or issuance of a new rating. About 21 per cent were negative rating or outlook actions and 14 per cent were positive. Nearly half of the negative actions were downgrades and about 75 per cent of the negative actions cited environmental considerations.