Movement of yuan puts pressure on Asean currencies

Goods sold on popular US and Europe-based e-commerce sites are now more expensive when their prices are converted to Singapore dollars.

The Singapore Interbank Offered Rate (Sibor), the benchmark interest rate to which most home loans in the city-state are pegged, has risen to a four-month high in the wake of China’s devaluation of the yuan.

The implications of the yuan devaluation are high in Singapore as its dollar closely tracks the Chinese currency.

The impacts are also heavy in other countries, chiefly Malaysia and Indonesia.

The losers are consumers looking for items from the West and companies that import their raw materials in US dollars but sell their products in local currencies, and those with exposure to US-dollar debt.

The yuan’s devaluation has led to tougher external conditions to such companies even before the US Federal Reserve starts to raise its policy interest rate, as top companies in the Asia-Pacific region have increased their debt level in the past years thanks to cheap funding costs.

According to Standard & Poor’s, aggregated reported debt of 100 companies under its review could exceed US$300 billion by the end of 2015, compared with about $275 billion in 2014 and about $260 billion in 2013.

The People’s Bank of China (PBOC) lowered the guidance rate for the yuan by 2 per cent against the US dollar on Tuesday, and on Wednesday it set it 1.6 per cent lower. Yesterday, it was lowered again by 1.11 per cent to 6.40 yuan per dollar.

In three days, the yuan has weakened by 4.7 per cent.

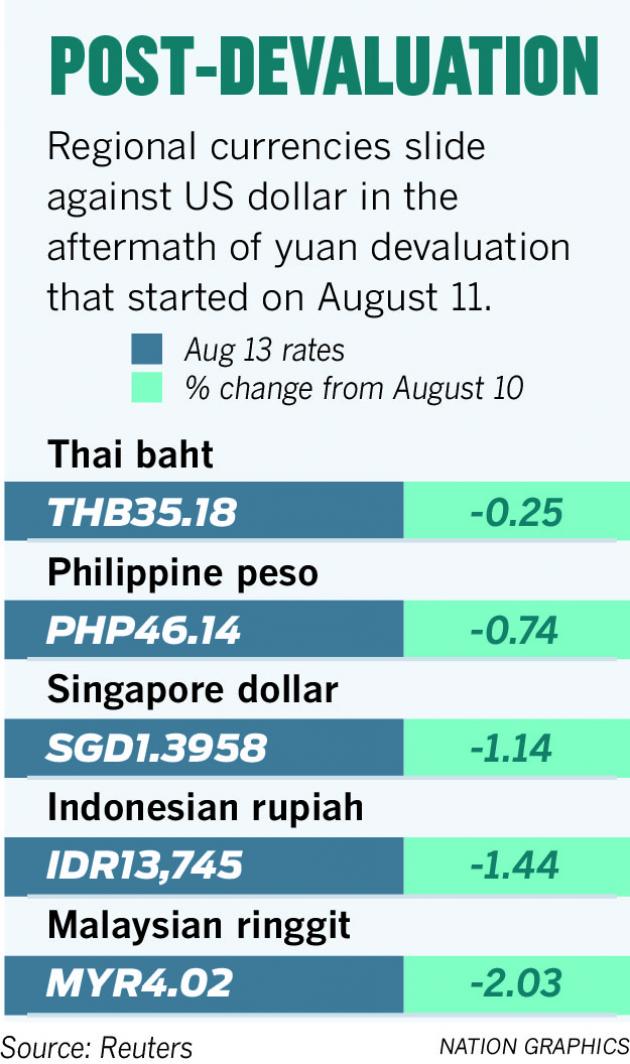

Expected to fall in tandem to maintain export competitiveness, Asean currencies were under huge pressure in the first two days, as investors were uncertain on the yuan’s direction. Stock markets tumbled. They staged a rebound yesterday after China’s central bank assured that the yuan, or renminbi, was still a strong unit and that Beijing would keep it stable.

"Currently, there is no basis for the renminbi exchange rate to continue to depreciate," PBOC assistant governor Zhang Xiaohui told a briefing, according to a transcript.

The baht’s loss against the dollar narrowed yesterday, strengthening to 35.20 against 35.53 on Tuesday. The SET Index fell as low as 1,382.7 points before ending at 1,404.15.

The yuan devaluation prompted different actions from Asean countries.

United Overseas Bank expects Singapore to come up with stimulus measures to shore up its currency.

On Wednesday, Vietnam’s central bank revised the exchange-rate band from plus/minus 1 per cent to plus/minus 2 per cent, setting the ceiling rate at 22,106 dong per US dollar and the lowest rate at 21,240 dong. It said the yuan’s devaluation would greatly affect trade between the two countries. China is Vietnam’s biggest trading partner.

Le Dac An, head of the investment division at Tan Viet Securities Co, said it was not easy to say this was good or bad, as the weaker dong could promote Vietnamese exports, but on the other hand, cheaper Chinese goods would flood the Vietnamese market and throttle domestic producers.

The governor of Malaysia’s central bank, Zeti Akhtar Aziz, yesterday said she expected volatility in the currency markets to remain until there was certainty in policy direction from major economies. She also emphasised that Bank Negara Malaysia had no plans to peg the ringgit.

At midday, the ringgit was firmer at 3.9960 to the US dollar compared with Wednesday’s fall to a new low at 4.0275.

On the recent ringgit depreciation, Zeti said it was expected during periods of capital outflows. She said Bank Negara would continue to ensure the orderly functioning of the market to avoid disruptions to trade and business activities.