Focus on domestic stocks, strategists advise

FINANCIAL STRATEGISTS are advising investors to “play domestic”, emphasising that the Thai economy must rely on local demand to drive growth.

Experts are also predicting that the Stock Exchange of Thailand (SET) could hit a high of around 1,850 points by the end of 2019.

“We would advise investors to make long-term investments in high-quality stocks and invest in the stocks of domestic firms to minimise the impacts from the volatile global markets,” said Chotechung Teerakajornchote, first vice president, Macro Strategies, Thanachart Fund Management Co Ltd.

He was speaking at a seminar yesterday on economic trends for 2019.

Investors in the SET should avoid companies with high debt-equity ratios and give priority to companies with return on equity no less than 10 per cent, according to Amphon Kositaporn, senior fund manager for equity fund at Thanachart.

Most importantly, investors should play domestic in their investment approach and focus on investing in domestic firms, he said. The most promising industries to invest in next year are the financial sector, healthcare and infrastructure, he added.

“This is because the financial sector is expected to regain its strength after this year’s high investment in new financial technology and security measures. Meanwhile, the healthcare industry will naturally grow as a result of Thailand’s ageing population. Finally, the Thai government has committed itself to various long-term infrastructure development projects,” he explained.

Chotechung told the seminar that international demand for Thai goods and services had become less reliable as a source for the country’s economic growth. “This is largely due the global market instability caused by the ongoing US-China trade war, divergent economic growth of the US economy leading to a stronger US dollar, and the Federal Reserve signalling an intent to hike interest rates.”

For example, Thailand’s exports in September were valued at $20.7 billion, down 5.2 per cent year on year. But in baht terms it was valued at Bt676.410 billion, down 6.2 per cent year on year.

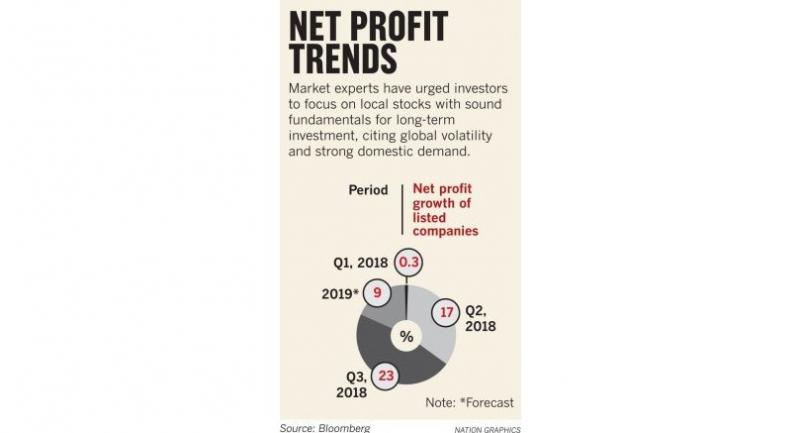

Meanwhile, Thai companies have been performing exceptionally well in 2018, he said, citing the average 23 per cent third-quarter growth in profit among companies listed in the SET.

However profit is expected to grow by 9 per cent in 2019, Chotechung said, and so economic growth next year will have to be largely driven by domestic demand.

Chotechung predicted that the stock market in 2019 would be in the range of 1,620 to 1,850 points. In a worst-case scenario, Thailand will see the SET dip to 1,520 points, but only in the event of an economic crisis such as the US stock market crashing, additional unexpected interest rate hikes by the US Fed or a rapid escalation of the trade war.

While the trade war has hindered Thai exports, it also presents an opportunity for the Thai economy, said Chotechung.

“The trade war has caused a shift in the global supply chain. As the US continues to impose higher tariffs on Chinese imports, various manufacturers based in China have been looking to move their production base to other countries.

Many of them are eyeing Thailand as an alternative manufacturing location,” he explained.

For example, Daikin Industries, a Japanese company that manufactures compressors, recently moved its production base from China to Thailand and Malaysia.

Furthermore, the bond market may also stand to benefit from the economic conflict. This is because Thai bonds are seen as a safe haven for foreign investors. As such, Thailand is one of the only emerging markets to have seen an increase in the number of non-residents holding local currency government bonds in September 2018 compared to the same month last year.