Banks can cope with losses from BOT measures: TBA chief

Bank loans to small businesses is expected to reach a total of Bt100 billion this year while the Bank of Thailand's measures requiring commercial banks to lower interest rates and fees for small businesses and retail clients would have little impact on their revenues, said Predee Daochai, president of Thai Bankers’ Association (TBA).

He was referring to the central bank’s latest directives for banks to change the method of interest and fee calculation that may result in lower revenues. The central bank also asked banks to help small and medium-sized enterprises (SMEs) restructure their debts.

Predee forecast that combined bank loans to SMEs this year is expected to reach Bt100 billion, providing ample liquidity to their operations. He said the new way of interest rate and fee calculation will not depress banks' revenues.

A projection made before the BOT measure on fee calculation pointed to a drop of 5 to 17 per cent in fee incomes this year given banks have different fee structures. However, he said the new measure introduced a few days ago would not significantly change the estimation.

The interest rate reduction on default debts is expected to be steep, but it is not a big part of banks' revenues and the impact is not significant, he said.

Chansak Fungfu, executive director and senior executive vice president of Bangkok Bank (BBL), said central bank’s measures to help debtors cut cost would also reduce banks' revenues. Banks have to adjust by adopting new technology or introduce new business models to tap other sources of income in compensating for the losses.

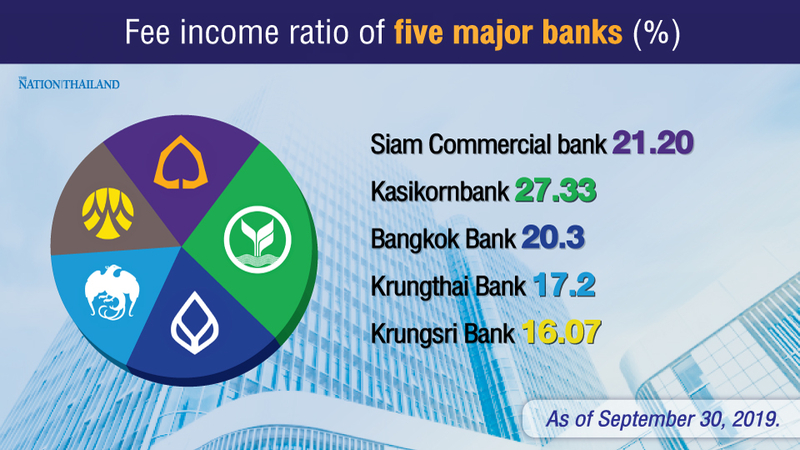

As of September 30 last year, Siam Commercial bank’s fee revenue accounted for 21.20 per cent of its total revenue, Kasikornbank 27.33 per cent, BBL 20.3 per cent, Krungthai Bank 17.2 per cent and Krungsri Bank 16.07 per cent.