Sovereign creditworthiness outlook for Asia Pacific negative: Moody’s

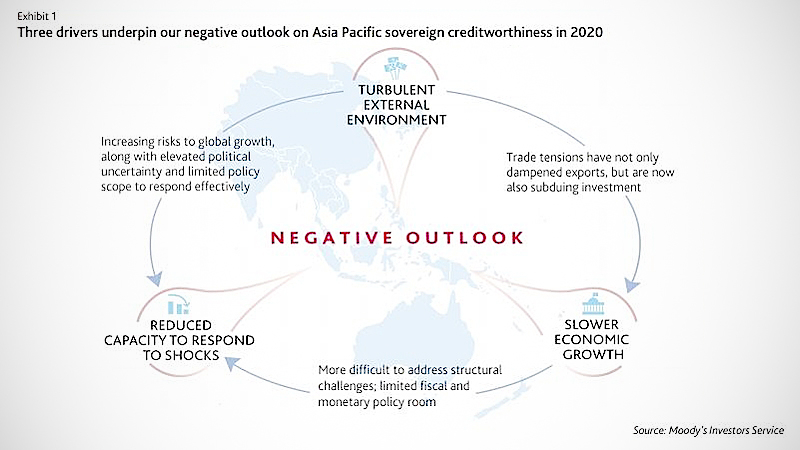

Moody’s Investors Service says in a new report that its outlook for Asia Pacific sovereign creditworthiness in 2020 is negative, underpinned by slower economic growth, a turbulent external environment and some governments’ reduced capacity to respond to shocks.

Moody’s has published an outlook report titled “Sovereigns – Asia Pacific: 2020 outlook negative as slower growth amplifies long-standing fiscal, liquidity and demographic challenges”.

A gradual slowdown in growth globally, exacerbated by trade tensions between China (A1 stable) and the US (Aaa stable) -- notwithstanding the phase one trade deal -- will constrain the credit quality of rated sovereigns in Asia Pacific, the report said.

"Despite the phase one deal, the prospect of the US and China agreeing on long-term issues like industrial policy, intellectual property and market access remains highly uncertain. As a result, the US-China trade relationship will remain a source of uncertainty and volatility in 2020,” says Martin Petch, Moody’s vice president and senior credit officer.

These trade frictions will spread via global supply chains, and Asia Pacific sovereigns embedded in global supply chains such as Hong Kong (Aa2 negative), South Korea (Aa2 stable), Malaysia (A3 stable), Singapore (Aaa stable) and Thailand (Baa1 positive), along with Vietnam (Ba3 negative) to a degree, will be impacted as a result, the report said.

Weakening trade is also curbing investment, which if sustained, will further reduce potential growth and amplify long-standing structural challenges including fiscal vulnerabilities and demographic change, the report added.

“In APAC [Asia Pacific], trade tensions are no longer simply exacerbating the global slowdown in trade volumes. The shock is now also extending to investment, with businesses putting off their expansion plans amid economic, political and policy uncertainties, which will hurt income growth, competitiveness and productivity in the long run,” adds Petch.

On average across Asia Pacific, Moody’s forecasts gross domestic product growth of 4.0 per cent in 2019-21, slower than 4.4 per cent over 2014-18, but still robust by global standards.

The erosion of fiscal positions as governments try to buffer against external and domestic growth shocks will be a risk for some sovereigns.

For governments such as India (Baa2 negative), China, Pakistan (B3 stable) and Sri Lanka (B2 stable), slower growth prospects will increase restrictions on fiscal space, further limiting the capacity of the authorities to support their economies.

A few, including Hong Kong, Korea and Singapore, have much more fiscal flexibility.

In addition, weaker growth will compound structural challenges in the region, which range from rapid ageing, to creating enough jobs for large and growing young populations in places like the Philippines (Baa2 stable), Indonesia (Baa2 stable) and Malaysia, the report said.

Amid heightened unpredictability, Asia Pacific’s frontier markets are vulnerable to any sudden shift in investor appetite.

Nineteen of Moody’s 25 rated Asia Pacific sovereigns have stable outlooks, while four have negative outlooks and two have positive outlooks.