SET expected to rebound 'June-end' as investors go in for ‘window dressing’

The Stock Exchange of Thailand (SET) Index is expected to rebound by the end of June as institutional investors are likely to buy up stocks as “window dressings”, experts said.

Window dressing is a strategy used by mutual-fund and other portfolio managers close to the year end or quarter end to improve the appearance of a fund’s performance before presenting it to clients or shareholders.

Asia Plus Securities research manager Paradorn Tiaranapramote said that in the past ten years, the SET Index has risen approximately 0.63 per cent during the last ten days of June, predicting that the index will rise to 1,380 points by the end of this month.

“In the past ten years, institutional investors have bought stocks as window dressings at the end of June and December,” he said. “Capital approximately worth Bt8.4 billion and Bt14 billion have flowed into the stock market in June and December, respectively,” Paradorn said.

He expected more capital to flow into the market because from June 1 to 18, institutional investors bought stocks totalling Bt1.48 billion, lower than the previous five months and lower than the original average of Bt8.4 billion.

“The market would gain positive sentiment from mass buy-offs in super saving funds for tax deduction, sales of which will end on June 30,” he said. “Meanwhile, we expect institutional investors to buy large-cap stocks, with prices rising more than the market.”

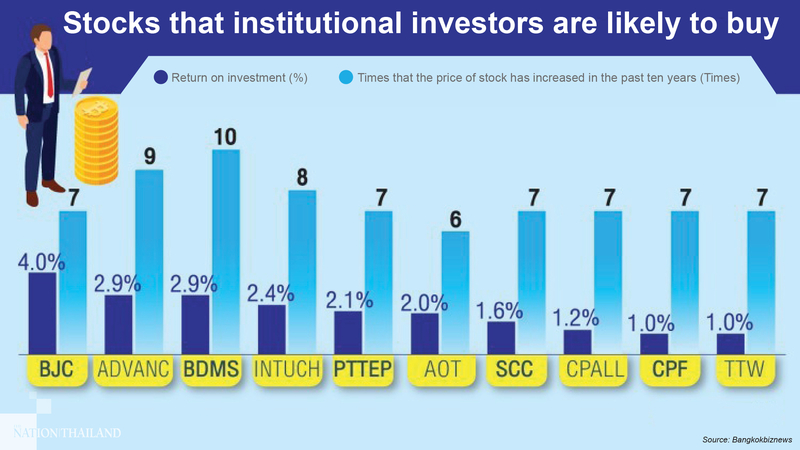

He recommended ten stocks institutional investors would buy – Berli Jucker (BJC), Advanced Info Service (Advanc), Bangkok Dusit Medical Services (BDMS), Intouch Holdings (Intuch), PTT Exploration and Production (PTTEP), Airports of Thailand (AOT), Siam Cement (SCC), CP All (CPAll), Charoen Pokphand Foods (CPF), and TTW.

Meanwhile, Tisco Securities senior strategist Apichat Poobunjirdkul said that according to a study on the movement of the Thai stock market at the end of every quarter since the global financial crisis in 2009, the chance that institutional investors will go in for a window dressing in the first quarter is 67 per cent, and 64 per cent in the second, third, and fourth quarters.

“Returns from window dressing in the first quarter are approximately 1.2 per cent and 1.4 per cent in the second quarter, contracting 0.5 per cent in the third quarter, and 0.0 per cent in the fourth quarter,” he said.