Emerging East Asian bonds feel the impact of Covid-19

The coronavirus disease (Covid-19) pandemic continues to drag on local currency bond markets in emerging East Asia as investment sentiment globally and in the region wane and containment measures limit economic activity, says the latest issue of the Asian Development Bank’s (ADB) Asia Bond Monitor.

“Governments and central banks in the region have taken significant measures to mitigate the impact of Covid-19 through fiscal stimulus packages and eased monetary policies. But more needs to be done to strengthen the region’s economies and financial markets,” said ADB chief economist Yasuyuki Sawada. “While overall investment sentiment is still down, there are signs of recovery in some economies as quarantine measures are strategically relaxed.”

Emerging East Asia is comprised of: China, Hong Kong, Indonesia, South Korea, Malaysia, the Philippines, Singapore, Thailand and Vietnam.

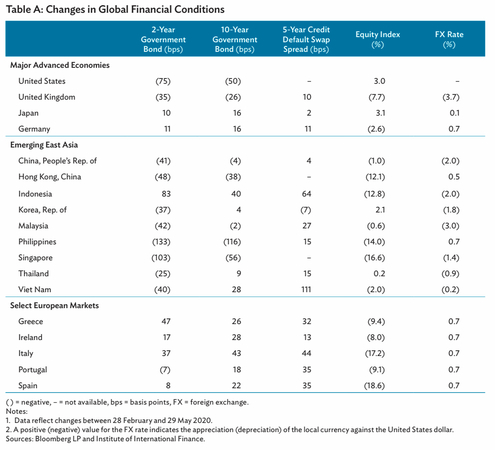

Government bond yields trended downwards in most regional markets between February 28 and May 29 this year, while equity markets in emerging East Asia suffered losses and local currencies depreciated against the US dollar.

Credit spreads have widened for nearly all markets in the region as investors took a risk-averse approach, with the share of foreign holdings in most of emerging East Asia’s local currency bond markets also declining.

Risks to the global outlook remain heavily tilted to the downside, mainly due to the uncertainty brought about by the Covid-19 pandemic, including the prospect of longer periods of minimal economic activity and further waves of outbreaks. Other risk factors include trade tensions between the China and the US, as well as financial volatility due to capital outflows from emerging markets.

Local currency bonds outstanding in emerging East Asia totalled $16.3 trillion at the end of March, up 4.2 per cent from December 2019 and 14 per cent higher than in March 2019. Bond issuance in the region reached $1.7 trillion in the first quarter of 2020, up 19.7 per cent from the fourth quarter of 2019. Emerging East Asia’s local currency bonds outstanding as a share of gross domestic product rose to 87.8 per cent at the end of March.

Government bonds outstanding rose to $9.9 trillion at the end of March, while corporate bonds reached $6.4 trillion. China remains the largest bond market in emerging East Asia, accounting for 76.6 per cent of the total bond stock at the end of the first quarter of 2020.

The second issue of Asia Bond Monitor this year explores the impact of Covid-19 on capital markets; the possibility of issuing pandemic bonds as an option to fight Covid-19; the rising attention to social bonds in response to the pandemic; using fintech to promote inclusive growth and pandemic resilience; and the infrastructure and policies needed for firms to obtain financing during the Covid-19 pandemic.

The report also includes a theme chapter on the link between financial architecture and innovation. It highlights the importance of a sound and efficient financial system in fostering a viable innovation environment.