Investors advised to hold more cash, watch 5 factors

An expert at Trinity Securities has advised investors to convert some of their stockholding into cash savings to prepare for the third quarter this year.

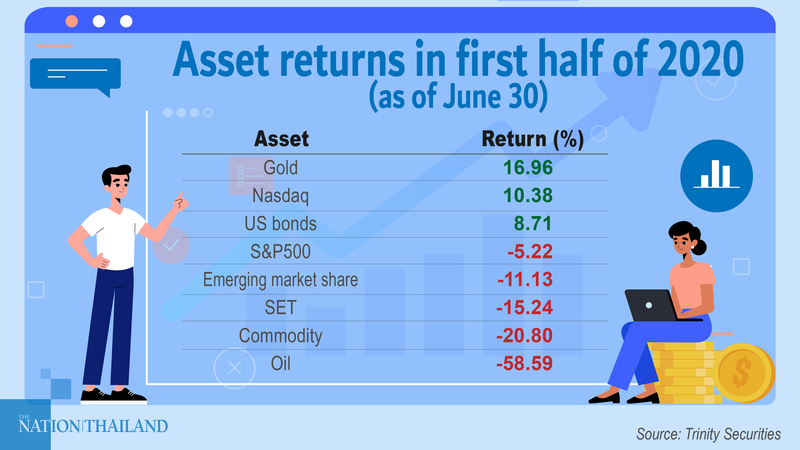

The second quarter saw the Thai stock market recover by 20 per cent, but negative sentiment persists over the Covid-19 pandemic, non-performing loans, the decline in GDP, and changes in asset values – all factors that are prompting investors to revise their investment strategy.

Nuttachart Mekmasin, a research analyst at Trinity Securities, said the Stock Exchange of Thailand (SET) Index rebounded quickly on hopes of economic recovery in the second half of 2020 but had hit a ceiling with no further rise expected soon.

He advised investors to hold 30 per cent in cash and invest 10 per cent in Thai stocks, 20 per cent in foreign stocks, 20 per cent in Thai and foreign bonds, 15 per cent in Real Estate Investment Trusts (REITs), and 5 per cent in gold.

"Regarding foreign stocks, we advise investing 10 per cent in developed markets and another 10 per cent in emerging markets, especially Europe, Japan, and MSCI Emerging Markets," he said.

"For REITs, we advise investing 10 per cent in foreign REITs because Thai REITs are focused on investment in assets affected by the Covid-19 impact."

He pinpointed five factors that investors should follow during the second half of 2020:

1. Economic policymakers' moves: Investors should follow any move to reduce injection of cash into the economic system as this will affect assets' value.

2. Economic recovery and listed companies' second-half performance: An absence of signs of recovery will trigger a severe market correction.

3. US-China conflict and US presidential election: These factors will affect the issuing of economic policies.

4. Thailand’s Covid-19 relief measures: Measures such as the Bank of Thailand's debt payment holiday and the SET's uptick rule will expire soon; investors will make more short sales if the SET does not extend the uptick rule period.

5. Opec's agreement to cut oil production: The oil price will drop again if demand increases.