SCG Packaging’s IPO expected to shake up the market

An analyst at Asia Plus Securities expects institutional investors to sell stocks worth Bt23 billion to buy SCG Packaging (SCGP) shares, resulting in market volatility.

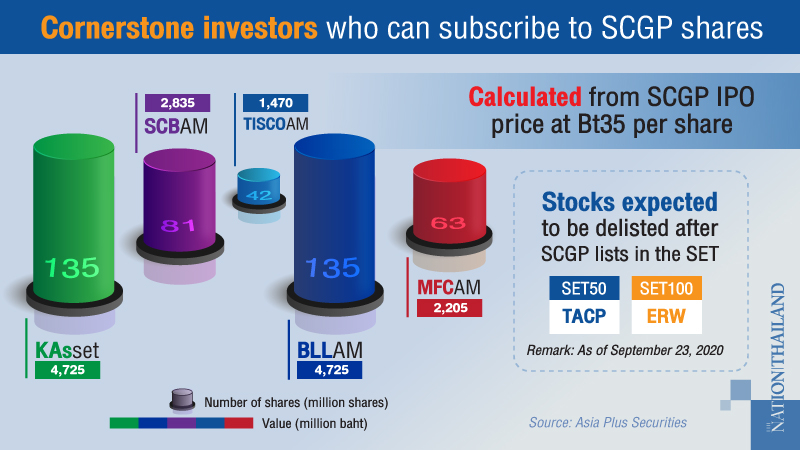

SCGP will make an initial public offering (IPO) of up to Bt1.12 billion with shares priced between Bt33.50 and Bt35 from September 28 to October 7. Meanwhile, cornerstone investors and initial purchasers will make payments for buying shares from October 9 to 14.

The analyst reckoned that institutional investors will sell off their stocks before SCGP is listed in the Stock Exchange of Thailand (SET). The 18 institutional investors, comprising 14 Thai asset management companies and four overseas asset management companies, have the right to subscribe to 676.53 million shares worth Bt23.7 billion.

"According to previous statistics, SET50 will fall up to 6 per cent in one month before large-cap stocks start making transactions in the stock market, while the price of stocks in the same group will drop by up to 10 per cent," he said.

"Over the past three days, the largest petrochemical stock price dropped sharply after SCGP announced it was selling IPO shares."

Since SCGP is a large-cap stock with a market capitalisation of around Bt150 billion and has the chance of being listed in SET50 or SET100 instantly, the analyst expects Thanachart Capital (TACP) with a market capitalisation of Bt35 billion to be delisted from SET50 or the Erawan Group (ERW) with a market capitalisation of Bt80 billion delisted from SET100.

"The securities company expects SCGP’s revenue this year to be at Bt6.99 billion, up 32.8 per cent year on year, while the company’s profit is expected to be Bt8.33 billion, up 19.1 per cent year on year," he added.