Thai banks remain resilient despite poor performance in Q3 2020 due to drop in profits

Suwannee Jatsadasak, Bank of Thailand’s senior director, said the country’s banking system has remained resilient thanks to high levels of capital funds, loan-loss provisions and liquidity to support economic recovery from the fallout of Covid-19 crisis.

Debt-relief measures, coupled with revisions to rules on loan classification and provisions facilitating bank-loan expansion have alleviated the deterioration of bank-loan quality, she said on Monday.

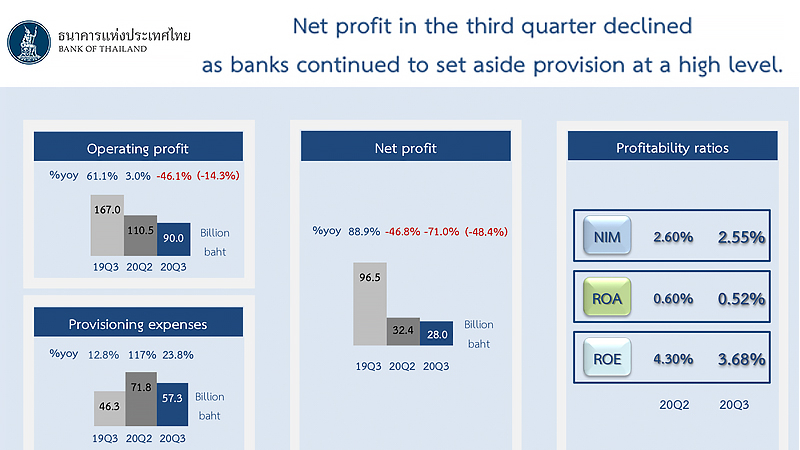

However, the banking system’s profitability has declined as banks continue to set aside high loan-loss provisions to cushion the adverse impact of Covid-19 on loan quality, she said.

Capital funds for the Thai banking system stood at Bt2.96 trillion, equivalent to capital adequacy (BIS) ratio of 19.8 per cent. Loan-loss provisions remained high at Bt782.5 billion with non-performing loan (NPL) coverage ratio of 149.7 per cent. Liquidity coverage ratio (LCR) registered at 184.9 per cent.

In the third quarter of this year, Thai banks’ overall loan growth stood at 4.6 per cent year-on-year, dropping slightly by 5 per cent from the previous quarter.

According to data available, corporate loans (64.6 per cent of total loans) expanded at 4.5 per cent year-on-year, but contracted quarter-on-quarter as some switched their funding source from bank loans to this issuance of bonds and equity.

Loans for small businesses showed a lower contraction, due mainly to the central bank’s soft-loans scheme and gradual recovery of the economy.

Consumer loans (35.4 per cent of total loans) grew at 4.8 per cent year-on-year, and increased quarter-on- quarter following the relaxation of lockdown measures. Mortgage lending, in particular, expanded consistent with an increase in demand for low-rise residential projects compared to the previous quarter.

Debt-relief measures, together with revisions to rules on loan classification and provisioning, have continued to alleviate banks’ loan-quality deterioration in the third quarter of 2020. The gross amount for outstanding NPLs (stage 3) stood at Bt513.9 billion, equivalent to 3.14 per cent of total loans, edging up slightly from 3.09 per cent in the previous quarter.

Meanwhile, the ratio of loans with a significant increase in credit risk (SICR or stage 2) to total loans stood at 7.03 per cent, down from 7.49 per cent in the previous quarter.

The banking system recorded net profit of Bt28 billion in the third quarter and Bt130.4 billion in the first nine months of 2020, a decline from last year owing to continued high-levels of provisioning expenses to cushion against the potential of further loan-quality deterioration.

As a result, the ratio of return on asset (ROA) dropped to 0.52 per cent from 0.60 per cent in the previous quarter. The ratio of net interest income to average interest-earning assets (Net Interest Margin: NIM) declined from 2.60 per cent to 2.55 per cent, largely due to a drop in interest income on loans.