Huawei chip unit short-circuited Trump's sanctions. Then it got burned.

For most of its history, Huawei's tinkering in semiconductors was considered little more than a curious hobby by industry rivals.

The Chinese technology company occasionally outfitted its smartphones with its homegrown Kirin chipsets, named after a mythical beast with the horns and hoofs of a deer and the scaly body of a dragon.

But Kirin chips remained a rare presence in the wild. Huawei's chip subsidiary, HiSilicon, attracted little outside attention until the Trump administration's sanctions on Huawei brought this backup squad to the front line.

"This was history's choice today, that our spare tires were all put into use overnight," HiSilicon's reclusive president, Teresa He, wrote to her staff in a letter dated "before dawn," after sanctions hit in May 2019. Google, Qualcomm, Intel and other U.S. companies suspended business dealings with the Chinese firm.

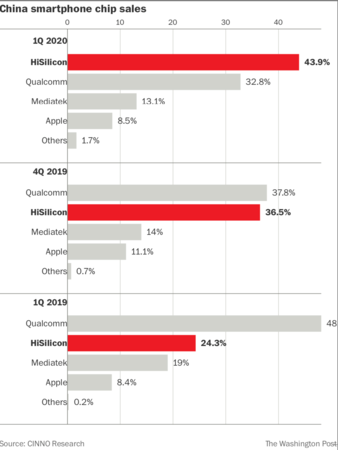

Depriving Huawei smartphones of Qualcomm's powerful processors was meant to cripple Huawei's smartphone business. But Huawei's handset sales stayed strong, bolstered by patriotic buying at home.

And a lot of these phones now had Huawei's chips inside them, pushing HiSilicon past Qualcomm to become China's No. 1 smartphone chip vendor this spring.

The Commerce Department was not amused. It tried again this May, forbidding the sale of U.S. technology not only to Huawei, but also HiSilicon's suppliers and the suppliers of those suppliers.

"For HiSilicon, it's really a big hit," Linda Sui, a director at research firm Strategy Analytics, said of the new sanctions. "Nobody can bypass U.S. technology."

A smartphone chipset looks unassuming - a small, black square - but it reflects the limit of how small and precise humans can draw a pattern. In high-end smartphone chips, each transistor, or switch, is so small that more than 10,000 of them, end to end, would still be less than the thickness of a sheet of paper. Each new generation must be smaller yet.

To cope with the crushing research costs, companies and nations decided decades ago to specialize. Today, a few companies flatten sheets of pure silicon into near-perfectly flat surfaces, while several others make machines that draw microscopic patterns with beams of light.

Other companies make software to design the circuit paths, and yet other companies construct the chips in rooms so clean the air is free of dust.

These specialized suppliers are now being told to pick between the United States or China, resulting in a profound remapping of the global semiconductor supply chain. A number have chosen the United States in recent weeks, deepening Beijing's urgency to develop its own suppliers.

For instance, Taiwan Semiconductor Manufacturing Co. - which manufactures cutting-edge chips for Huawei as well as Apple and other leading brands - said earlier this month it will follow the U.S. sanctions, leaving HiSilicon in the lurch.

Semiconductor fabrication plants, or fabs, like TSMC have little choice but to abide by the U.S. sanctions, as they rely on U.S. suppliers to operate, said Dan Wang, a technology analyst at Gavekal Dragonomics.

"Any modern semiconductor fab requires U.S.-origin equipment," he said.

Huawei has been quiet on the new sanctions, beyond a statement in May saying its business would be "inevitably affected." It declined last week to comment further.

HiSilicon was formally established in 2004, on the heels of a major humiliation for Huawei. Cisco Systems had sued Huawei the previous year, alleging its Chinese rival had copied and pasted some of its router code for use in its own cheaper products.

The case was settled out of court, but Huawei's reputation was battered. Huawei's founder, Ren Zhengfei, came close to selling his company to Motorola in 2003, believing a U.S. alliance would help Huawei survive future clashes with the West.

"We were hesitant, and we wondered if it would be possible for Huawei to wear an 'American cowboy hat,' " Ren told Chinese media in an interview last year, according to a transcript released by the company. "If we had been sold to this company, we would have been able to get our American cowboy hat and try to take the world by storm."

The deal fell through at the 11th hour, and Ren said younger Huawei executives were adamant against trying to sell the company again.

Ren spun off Huawei's fledgling chip team into an official subsidiary in 2004, pouring in so much money that HiSilicon earned the colorful internal nickname "the cash-sucking baby that will burn your hands," according to state media reports. HiSilicon remained unprofitable from 2004 to 2013.

HiSilicon recruited experienced engineers globally, from Canada to Germany to Taiwan. In recent years, it has unveiled advanced processors on par with leading Western brands, although its limited production scale kept it off the radar as a major challenger.

Today, she is the only woman to lead one of the global top 10 semiconductor vendors, after HiSilicon entered the ranks this spring. In keeping with Huawei's low-key culture, the former engineer has never given a media interview. She declined to be interviewed for this article.

Her letter to employees last year, however, reflected unmistakable excitement that after years of toiling quietly on "spare tires" kept in reserve, HiSilicon was being fully unleashed.

"We have safeguarded the strategic security and uninterrupted supply of a large share of Huawei's products!" she wrote. "On this darkest day, every ordinary son and daughter of HiSilicon has become a hero of the era!"