Household debt expected to remain above 80% of GDP

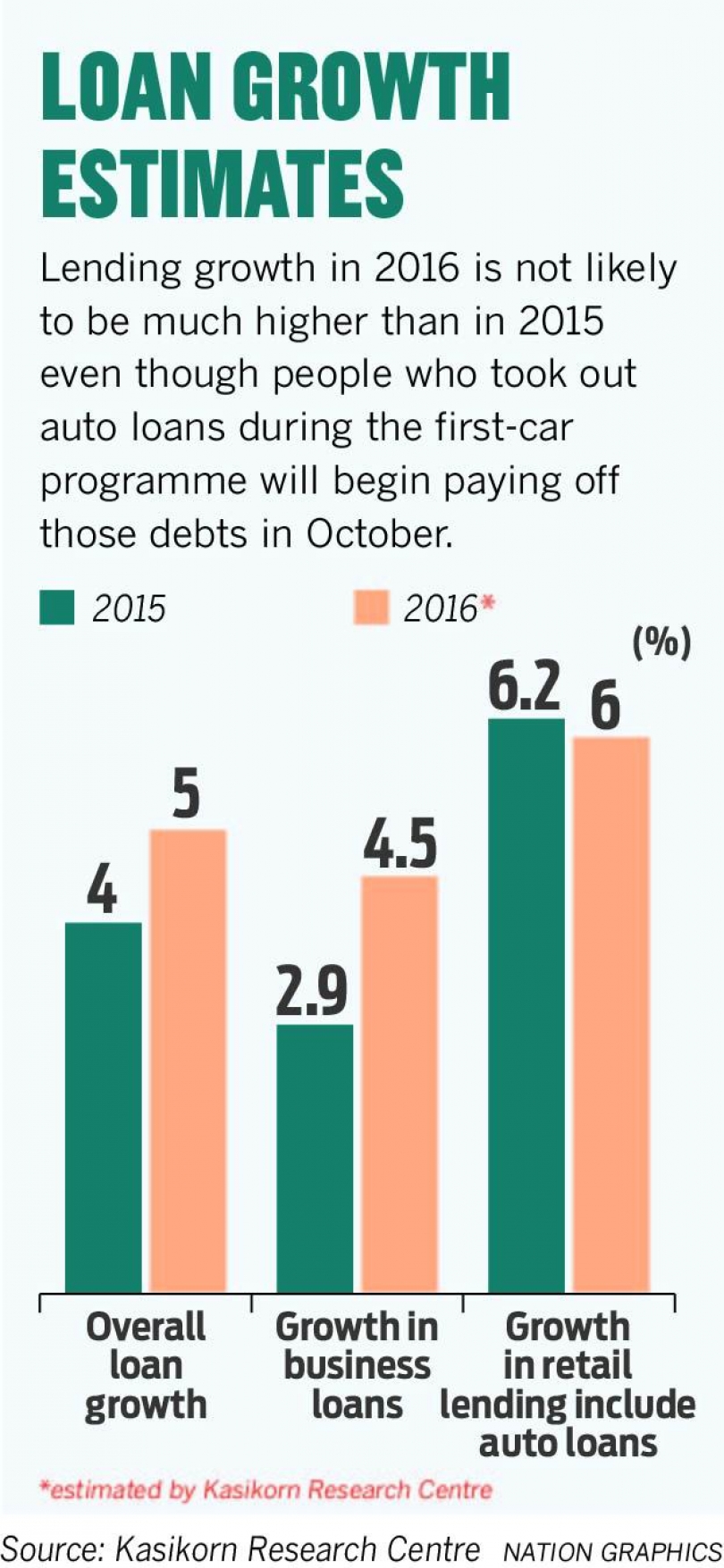

The level of household debt this year is expected to continue to exceed 80 per cent of gross domestic product even though some people who borrowed to take advantage of the previous elected government’s first-car scheme will pay off that debt in the fourth

Thanyalak Vacharachaisurapol, head of money and banking at Kasikorn Research, said household debt this year would touch 83 per cent of GDP, against 81 per cent at present, because consumer borrowing has continued to rise.

Each year, there is new borrowing of auto and housing loans, so the fact that some of the first-car borrowers will pay off their loans this year does not mean overall household debt will decline quickly. However, it may help improve the purchasing-power situation by the end of this year.

According to KResearch, 1.26 million vehicles were purchased under the previous government’s first-car tax-break programme.

Thanyalak said the annual Motor Expo at the end of the year could encourage some of the first-car buyers to purchase new models.

Yet, the first car buyers don’t have debt service much to create debt from durable goods such as housing loan.

The loan term for buyers under the first-car scheme ranged from five to seven years, so even though they will be free of those debts by next year, their purchasing power might not rebound quickly, she said.

Anuchart Deeprasert, chairman of the Thai Hire Purchase Association, said the first lot of vehicles transferred to buyers under the first-car programme amounted to only 10,000 units and was made in October 2011. Therefore, even though those people will pay down their debt, the small volumes will not be enough to lower overall household debt.

To the data of the Thai Hire Purchase Association, which complied from 33 hire purchase members, the outstanding auto loan was Bt900 billion.

Anuchart said the purchasing power of such people was not expected to pick up sharply after they paid off their loans because those who took advantage of the first-car programme were largely young first-jobbers, who are unlikely to buy new models after owning their cars for five years because their incomes are low. Only 10 per cent of first-car-scheme buyers will change to new models, he said.

In fact, the purchasing power is not likely to pick up much until the fourth quarter of 2017, because by that time around 40 per cent of first-car-scheme loans will have been paid off.

Auto loans are not the only category increasing the level of household debt. Anuchart said consumers had racked up a lot of debt over the past four years because they did not anticipate a sharp economic downturn. Then when the economy slowed, some took out personal loans and used their credit cards to help their cash-flow situation.

Sutharntip Phisitbuntoon, a senior executive vice president at Land and Houses Bank (LH Bank), said the main plus for the bank after customers paid off their auto loans would be from those who had undertaken debt restructuring. Once their financial burden was lower, they could resume repaying their debts normally.

"We don’t think the purchasing power will pick up much and the bank doesn’t think that when they don’t have an auto-loan burden, they will consider taking on more debt such as a mortgage," she said.

The lower purchasing power has caused LH Bank to shift its focus to financing condominiums along mass-transit routes priced at around Bt2 million.

The approval rate for housing loans at LH Bank is only 30 per cent, down from 40-50 per cent in better times, showing that more consumers don’t have the ability to service mortgages.

In the past, LH Bank loaned to customers buying homes costing as much as Bt7 million.