Asian consumers lead index in new tech adoption

For the past 10 years, Asia has been repeatedly touted as the next big thing that will change the world economy. Enter 2019, that’s not true anymore. Asia IS already the BIGGEST thing for adoption of tech products with advanced features.

Over the past 20 years, the middle-class segment in Asia has been burgeoning, and with their increased spending power, they are buying more new tech products.

According to a report by Wolfensohn Centre for Development, in 2009 28 per cent of the world’s middle-class was estimated to come from Asia. Come 2020 and this percentage is expected to hit 66 per cent, compared to just 50 per cent in United States.

WWith their newfound wealth and spending power, Asians are keen to adopt new tech products, and are particularly interested in products that are novel, fun and sophisticated. This is mostly great news, but there’s still a “but”.

With choices galore, buyer sophistication is rising in Asia, and often retailers, advertisers and brands have less influence on purchase decisions. According to a study by GfK (Growth from Knowledge), 62 per cent of Asia-Pacific consumers turn to online reviews from other shoppers and 56 per cent seek personal recommendations before making purchases, so word-of-mouth and social influence plays a bigger role in purchase decisions.

In addition, brand loyalty is rare among Asian consumers as nearly two in every three (64 per cent) respondents surveyed in Asia said that they are less loyal to any one brand – a 7-percentage point jump from two years ago. In comparison, the proportion of respondents in the US and Europe who shared the same sentiments were significantly lower.

If the above sounds like bad news, don’t worry, it’s not all doom and gloom. With the right approach, marketers and brands can still garner consumer interest and attention.

Here is an approach to engaging early adopters in Asia.

Getting it right – Introducing the New Tech Adoption Index

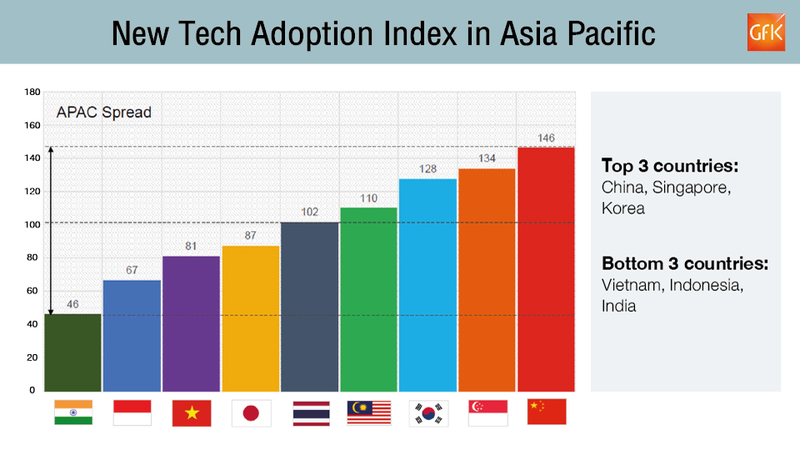

Based on GfK’s proprietary point-of-sales data, we analysed new consumer technology adoption of over 250,000 products in the consumer durables and technology industry across nine Asian and six key European markets to create an Index known as the New Tech Adoption Index.

The Index indicates a market’s propensity to adopt new tech products based on how much higher or lower they are positioned from the baseline of 100. The index helps brands and retailers understand the consumers’ inclination towards adopting technology and consumer products with advanced features or technology.

The index also shows a wide-ranging spectrum of new tech adoption from 46 to 146 across Asian markets, highlighting the vastly differing levels of adoption in the region. Two of the fastest growing economies; China and India are on the opposite ends of the spectrum with China leading the index, and India scoring the lowest, while the adoption in Thailand is positive at 102.

As part of the index, we have also classified consumer technology products into four different segments:

• Fun & Social: Products that enhance home living and boost entertainment experience, like headsets, panel TVs and loudspeakers

• Comfort & Convenience: Products that make life comfortable and making cleaning easier, like vacuum cleaners, washing machines, air conditioners and air treatment

• Freedom & Lifestyle: Products that empower people and make life on-the-go much easier, like headphones, digital cameras and wearables

• Essential & Integral: A must-have for individuals who want to be adept, informed and in control, like smart phones.

We found that unique country-specific traits take centre stage when it comes to the adopting of new tech products. For instance, new tech adoption for the “Freedom” category is led by Indonesia, Vietnam and Thailand, where the population is generally younger, while the mature markets of South Korea, China and Singapore exhibit higher new tech adoption for the “Fun”” category due to their greater spending power.

What does this mean for brands, and how to win in Asia?

With an undeniable desire for all things tech, Asia is a haven for new product testing. Apart from this, what else can be done?

Take Asia seriously to launch new tech products

When it comes to tech, Asia is no longer playing second fiddle to the West. Therefore, it is practical for marketers to launch new tech products in Asia as the interest and take-up rate among Asian consumers are on the rise.

Experiment boldly

Audiences in Asia are less loyal to brands; love new experiences and enjoy sharing their perspective and being heard. Brands that don’t keep up with these expectations to offer unique experiences, will fall behind the competition. Therefore, whether it’s AR, VR or good old retail, it is wise to invest in creating unforgettable moments.

Go hyperlocal

Too many marketers still see Asia as a single entity and could not be more wrong. Use hyperlocal insights to reach your audience where it matters and take into consideration the cultural and behavioural differences between each country, as being generic is not the way to go.

Put mobile first

With 55 million active mobile internet users in Thailand, Thai consumers are using their mobile devices for shopping and payments. Focus on developing an effective mobile-marketing strategy to engage and convert your target audience.

Work on buyer experience and capitalise on their passion for technology

We observed that 33 per cent of respondents living in Asia Pacific reported that they are always among the first to try new technology and electronic products. Case in point: 69 per cent of them said they were open to making purchases on smart home devices such as smart speakers.

These broad principles aside, what is more important is for retailers to refrain from treating Asia as one homogeneous market – it is not ideal to adopt a one-size-fits-all approach for your marketing strategy.

It is important for brands to understand where their greatest potential of early adopters are, as this group can create a network effect for their products, and here’s where the New Tech Adoption Index comes in handy as it can help identify key markets, and even pinpoint the specific cities and regions within each market for brands to succeed in.

About the Author:

Vishal Bali is managing director for GfK Asia’s Apac-Middle East, Turkey and Africa segment and is responsible for driving client value and growth across GfK’s businesses in these markets.