Dow plunges as Trump tries to pin 'impeachment nonsense' for Wall Street rout

October's history as an irascible month for stocks reared its head in its first two days as markets plunged on fears both real and imagined.

Update: Dow Jones closed, down 1.86 per cent, Nasdaq 1.56 per cent down and S&P500 down 1.75per cent.

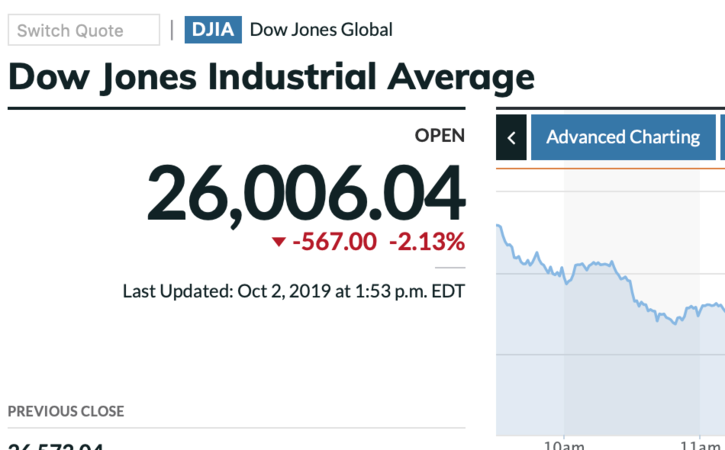

The Dow Jones industrial average gave up all its September gains and then some, plunging more than 800 points by Wednesday afternoon, the second day of the month. Technology received the biggest shellacking, with Visa, Intel, and Cisco all running in the deep red.

The pullback's immediate cause was Tuesday's dismal manufacturing report, but fears of a slowdown, complications over Brexit and never-ending trade anxiety weight on investors.

"October's reputation is preceding itself," said Sam Stovall of CFRA Research. "Historically, October has witnessed 30 percent higher volatility than the average month."

The Dow blue chips slumped nearly 600 points, or more than 2 percent, in early Wednesday afternoon trading. Wednesday's mayhem followed a rocky start on Tuesday, which saw a 344-point drop after the Institute for Supply Management's manufacturing index signaled that September was the worst month for U.S. manufacturing in more than a decade. Tuesday wiped out all of September's market gains.

The Standard & Poor's 500-stock index and Nasdaq composite index were 2 percent in the red Wednesday, the worst day for stocks since Aug. 23. All 11 stock market sectors had sunk by early afternoon, led by the industrials and the information sector.

Analysts were finding it difficult to put an exact cause on the selloff. Some referred to October itself as a jinx month that hosted historic crashes in 1929, 1987, 1997 and the financial meltdown of 2008. The month is also known for being a "bottom" for bear markets that have then reversed and turned upward. Others even speculated that Sen. Bernie Sanders. a Democratic presidential candidate, exacerbated the sell-off because of reported health problems. Some on Wall Street fears that Sanders' Democratic rival Sen. Elizabeth Warren would be unfriendly to Wall Street if she won the presidency.

"It is all speculation on the source of weakness in the near term," said Nancy Tengler of Tengler Wealth Management. "Manufacturing was disappointing. Job growth is slowing. In the very short term, the algorithms are reading the headlines and the sell programs are taking over. I am not panicking yet."

President President Trump blamed "all of this impeachment nonsense, which is going nowhere." In a tweet midday Wednesday, he blamed the inquiry for "driving the Stock Market, and your 401K's down. But that is exactly what the Democrats want to do. They are willing to hurt the Country, with only the 2020 Election in mind!"

Trump's tweet marked the second time in two days that he has punted the blame for negative economic news. On Tuesday, in the wake of the dismal manufacturing report, he tweeted that Fed Chair "Jay Powell and the Federal Reserve have allowed the Dollar to get so strong, especially relative to ALL other currencies, that our manufacturers are being negatively affected."

"Fed Rate too high. They are their own worst enemies, they don't have a clue. Pathetic!" he wrote.

The impeachment drama comes as economists have grown more concerned that the ongoing U.S.-China trade war and the slump in manufacturing could have ripple effects for the rest of the U.S. economy.

"There is no end in sight to this slowdown, the recession risk is real," said Torsten Slok, chief economist at Deutsche Bank Securities, in an email to clients Tuesday.

Hiring cooled in August, and a new report Wednesday from ADP and Moody's Analytics found that the private sector created more jobs than expected in September, even while the pace slowed alongside concerns of a tight labor market.

Companies hired 135,000 more workers in September, according to the jobs report, topping the 125,000 that economists surveyed by the Dow Jones had expected. But the September figure was the slowest since June and brought the 2019 monthly average down to 145,000 - markedly down from the 214,000 for the same period last year. The September numbers were also down from August's 157,000.

American consumers are increasingly propping up the global economy, but there are concerns that confidence could begin to slip. U.S. vehicle sales for Ford Motor declined 4.9 percent during the third quarter, the company said Wednesday, with demand for the top-selling F-series pickup starting to slouch. The company's stock was down 4 percent midday Wednesday.

The National Retail Federation is set to issue its holiday season forecast Thursday.

Tuesday's manufacturing news erased hopes of a quick turnaround for the industry and bruised Trump's vows to revive American blue-collar jobs. Manufacturing fell into a "technical recession" in the first half of the year, and the latest ISM data suggests that situation is only growing more grave.

The European markets were on a downturn, with the FTSE down more than 230 points, or 3.2 percent, and the DAX down nearly 300 points, or 2.4 percent. The S&P 500 was also roughly 50 points in the red.

Also on Tuesday, the World Trade Organization downgraded its forecast for global trade growth for this year and next. The U.S.-China trade war and a global economic slowdown spurred economists to project that world merchandise trade volume is expected to rise 1.2 percent in 2019 - markedly slower than the 2.6 percent forecast in April. For 2020, the forecast estimates 2.7 percent growth instead of 3 percent.

The cut forecast came mere weeks after Trump called China a "threat to the world" and said there was little urgency for an interim trade agreement. On Sept. 20, he told reporters he was under no pressure to reach a deal with China before the 2020 election, despite his early insistence that China was eager to return to the negotiation table.