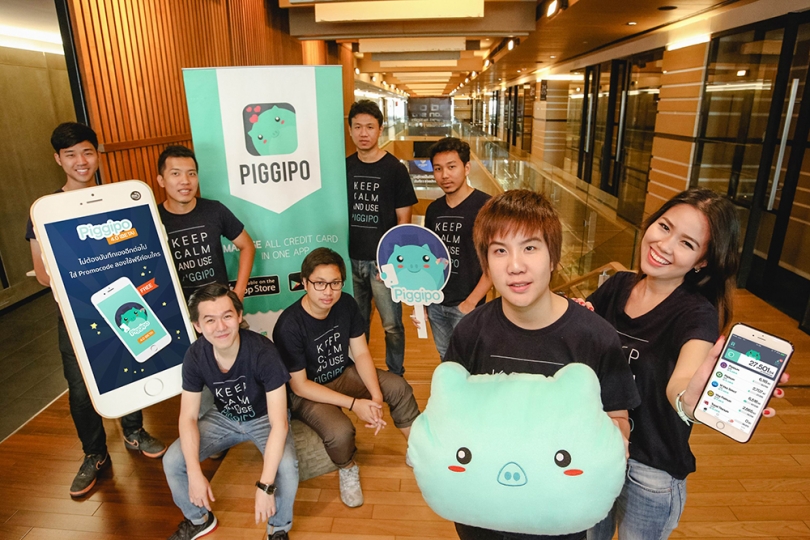

Pain over credit-card debt led to popular app’s launch

Piggipo’s sharp growth over past two years has seen it expand regionally

Piggipo, a two-year-old company selling credit card management applications, has set a goal of raising series-A funding by the end of 2016 before actively exploring Southeast Asia in 2017.

Chief executive Supichaya Surapunthu, 23, founded the company based on her experience as a credit card debtor and in doing so she went from a newly graduated business-degree holder to developing an application to help people better manage their credit-card use.

“I had a passion to have my own business since I was young. That’s why I chose to learn at Thammasat Business School,” she said.

“The idea for Piggipo was to do with my own [credit card debt pain] and having an application to help me to manage my credit card usage. At the time, I couldn’t find any application [that did that], so I made it myself.”

After an initial and unsuccessful six months of trying to deliver the application, she realised she need a team to help her. So she founded Piggipo in 2014 as the co-founder with her friends, Sirathorn Thamprateep, chief marketing officer, and Pongchai Tangbowonweerakun, chief technology officer.

A few month later, the first version of the Piggipo app debuted and had over 4,000 download without any spending marketing – only posting marketing content on web boards.

The turning point for Piggpo came when it won Dtac’s Accelerate Batch 2 online application competition. Piggopo got support and funding from Dtac. Supichaya said that being promoted by Dtac help accelerate the growth of Piggipo because it gave the company credibility and trustworthiness.

Piggipo allows people to better manage credit cards by allowing them to jot down their credit card spending details in an app. The premium feature costs US$1.99 (Bt70).

“Around 5 per cent of our active users pay an in-app purchase to unlock the [app’s] categories from only 12 to 49,” Supichaya said.

Apart from in-app purchase, Piggipo recently released a synced version to allow users to sync their credit card spending records into the app and have them categorised and issue notifications. Users are charged monthly or annual fee.

The app supports three credit card issuers, SCB, KBank and Citibank. By the end of this year, the company plans to have two more banks and 500,000 downloads, up from about 170,000 downloads now.

“Twenty per cent of the total downloads are active users and 5 per cent of active users buy the in-app purchase,” Supichaya said. “We are now starting to offer the synced version to facility users so users don’t have to jot down their spending as the app will sync all credit transactions for them. With this feature, we have more revenue streams from subscriptions.”

Along with Dtac, Piggipo also received seed funding from Golden Gate Venture, 500 TukTuks and Seeds Club.

Supichaya said the funding would help the company achieve the 500,000 download target, expand from iOS to Android and market the app to a wide audience.

She said Piggipo planned to raise series-A funding by the end of this year with the aim of receiving over $1.5 million so the company can further penetrate regional markets.

The two target markets at present are Malaysia and Singapore because these two countries have high credit card penetration and high credit card spending.

Piggipo has partnered with Maybank to launch the Credit Mavin app in Malaysia. Credit Mavin is the same concept as Piggipo but works on the international market.

“Piggipo was in the final five startup teams in the MaybankFintech programme who have been partnered with Maybank to launch services in Malaysia. From a total of 20 teams who were selected for the workshop in a four-day bootcamp, only five teams were selected to signs as partners with Maybank,” Supichaya said.

She believes there is a huge opportunity for Piggipo in Thailand and the region since the app is in line with the increasing use of digital money and electronic payments across the region.

The Bank of Thailand said that even though Malaysia had half the population of Thailand, its credit card spending is two-times bigger.

“We are a part of personal finance management,” Supichaya said.

“ We started from wanting to help people manage their credit cards but in the future we can expand the service to cover any kind of electronic cards including debit cards, loyalty cards and whatever.

“Thus, we need to get and keep users to be stay with Piggipo.”

RELATED